Ever looked at your bank statement and stumbled across a line that reads POS DEBIT? Maybe it left you scratching your head. Don’t worry — you’re not alone. The term ‘POS debit’ might sound technical, but it’s an integral part of your everyday financial life.

In this guide, you’ll learn what is pos debit and POS debit meaning, how debit card POS transactions work, and how they impact your bank account and spending. Whether you’re shopping at Walmart or subscribing to Peacock, POS debit is working behind the scenes.

Choosing the best free POS system & cloud-based POS debit systems click here!

Today, POS debit is used in over 30% of U.S. payments and 70% in Asia-Pacific retail (FRB, Coinlaw). As debit card POS transactions grow, it’s key to understand terms like POS debit charge or POS hold on a debit card on your statement.

Introduction to POS Debit

POS Debit Meaning in Simple Terms

A POS debit is essentially where you use your debit card to make a payment at a point of sale, like a checkout counter in a store or an online payment gateway. Money is deducted instantly from your checking account.

Why Understanding POS Debit Matters

Understanding what is POS debit. POS debit is the best way to get rid of sudden surprises, fraud detection, and a more reliable management of your finances. It’s one of the most common transaction types likely to appear in your bank’s history.

What Does POS Debit Mean in Banking?

What is POS Debit?

A POS debit is a purchase made using your debit card at a point-of-sale terminal or through a merchant’s online store. Unlike credit transactions, your money is pulled immediately from your account.

What does POS Debit mean?

The term POS debit refers to a transaction in which the debit card is utilized at a point-of-sale terminal for immediate deduction of the purchase amount from your bank account during the time of purchase.

What is POS Transaction in Debit Card Use?

A debit card POS transaction is initiated when you insert, swipe, or tap your debit card to pay. These transactions can be in person or online and are labeled as POS DEBIT on your statement.

Difference Between POS Debit and POS Credit

The key difference:

- POS debit pulls money from your own bank account.

- POS credit charges the amount to your credit card, to be paid later.

How Does a Debit Card POS Transaction Work?

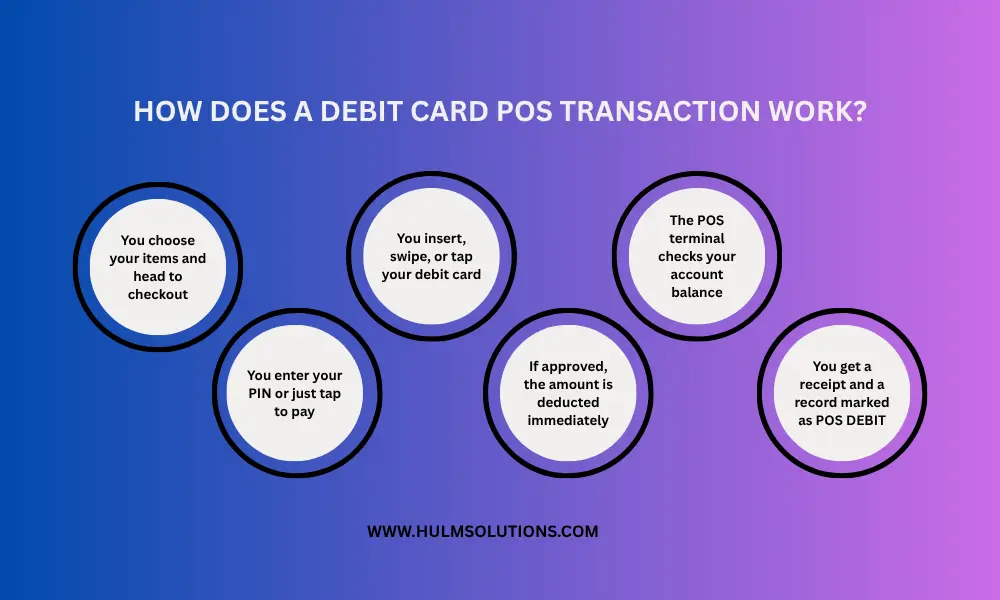

Step-by-Step Process of Debit Card POS

- You choose your items and head to checkout.

- You insert, swipe, or tap your debit card.

- The POS terminal checks your account balance.

- You enter your PIN or just tap to pay.

- If approved, the amount is deducted immediately.

- You get a receipt and a record marked as POS DEBIT.

Real-Life Example of POS Debit

Buying a Netflix gift card online with your debit card? That’s a debit card POS transaction. It’ll show up as POS DEBIT NETFLIX or similar in your bank records.

For more information about: POS Transaction click here!

Types of POS Debit Transactions

In-Store POS Debit

Shopping in physical stores like Walmart or Target using your debit card is the classic POS debit scenario.

Online POS Debit

Paying through Amazon using your debit card? That’s still a POS debit transaction — just virtual.

Contactless POS Debit

Tap-to-pay with your card or phone is another version of POS debit — fast, secure, and becoming the norm.

If you want Improving the POS experience click here!

What is a POS Debit Card and How to Use It?

A POS debit card is a payment card linked to your bank account, used to make purchases at point-of-sale (POS) terminals. You can use it by swiping, inserting, or tapping the card at a store’s checkout. The amount is directly withdrawn from your account. It also works for online and mobile payments, offering a convenient and cashless way to shop.

Features of POS Debit Card

A POS debit card is just your regular bank card enabled for point-of-sale transactions. It lets you make purchases anywhere a POS system is available — including online.

Benefits of Using POS Debit Over Cash

- Instant digital record

- Safer than carrying cash

- Accepted almost everywhere

- Easy to track spending

Learn about: how a debit card POS machine works click here!

Where You Commonly See POS Debit Charges

POS Debit at Retailers

Grocery stores, electronics outlets, and fashion chains — all POS heaven.

مطاعم, Gas Stations & Subscription Services

When you dine out, fuel up, or subscribe to Peacock, you’re triggering a POS debit transaction.

For get: best POS system for debit card POS payments click here!

POS Debit Peacock – What Is It?

A POS debit Peacock charge simply means you paid for the Peacock streaming service using your debit card. It’s a legit POS transaction.

What is a POS Debit Charge on Your Statement?

How to Read Bank Statement POS Charges

Seeing something like “POS DEBIT AMAZON MKTPLACE” on your statement? That means you bought something using your debit card POS system.

What Does POS Debit Mean If You Don’t Recognize It?

Sometimes merchant names appear differently. If you’re unsure, search the merchant online or contact your bank to confirm. An unrecognized POS debit could also signal potential fraud.

For more information about: Reconciling POS debit transactions click here!

Are There Fees for POS Debit Transactions?

Domestic vs. International Debit Card POS Charges

Most local POS debit transactions are free. But international POS charges may include currency conversion and foreign transaction fees.

How Banks Handle POS Debit Fees

Check with your bank. Some offer fee-free debit card POS transactions, others might charge if certain limits are exceeded.

Pros and Cons of POS Debit Transactions

| Benefits of Using POS Debit | Disadvantages and Limitations |

|---|---|

| Fast and convenient | Overdraft risk |

| Widely accepted | Limited fraud protection vs. credit |

| No credit risk | Potential transaction fees |

| Instant notifications |

Debit Card POS vs ATM Withdrawal

Use Cases and Differences

- Debit card POS = buy stuff

- ATM withdrawal = take out cash

Both use your account, but POS debit is tied to purchases, not withdrawals.

Which One is More Secure?

POS transactions using chip or contactless are generally safer than withdrawing cash at an ATM.

Security Tips for POS Debit Transactions

How to Keep Your Debit Card POS Safe

- Use tap-to-pay when available

- Don’t share your PIN

- Check your balance daily

- Enable SMS/email alerts

Best Practices to Avoid Fraud

Always double-check merchant details, especially with online debit card POS transactions. If anything seems off — freeze your card and contact your bank immediately.

What to Do If You See a POS Debit You Didn’t Authorize

How to Dispute a POS Debit Transaction

- Verify the charge

- Call your bank ASAP

- File a dispute

- Monitor your account

Bank Protocols for Investigating POS Charges

Banks usually reverse suspicious POS debit charges temporarily while they investigate. Be ready to provide supporting details.

How Businesses Handle POS Debit Transactions

The Role of POS Systems in Debit Transactions

POS systems process payments, generate receipts, and instantly request funds from customer accounts.

Speed and Settlement Time of POS Debit

Most debit card POS transactions settle within 24 hours, sometimes even faster with modern banking systems.

The Future of Debit Card POS Transactions

POS Debit Trends in 2025 and Beyond

Expect more biometric POS, advanced AI for fraud detection, and faster, real-time settlements.

AI, Biometrics, and the Next Generation of POS Debit

AI is helping make POS debit transactions smarter, faster, and safer — paving the way for a cashless future.

For information about: POS Purchase click here!

الخلاصة

Understanding the POS debit meaning and how a debit card POS transaction works gives you an edge in managing your money. From retail shopping to online subscriptions like Peacock, knowing the story behind a POS debit charge empowers you to track your spending and protect your finances. Stay alert, stay informed, and let your debit card do the heavy lifting.

الأسئلة الشائعة

A POS debit on your bank statement means you made a purchase using your debit card at a Point of Sale — either in a physical store or online. The amount was instantly deducted from your checking account.

POS debit pending means the transaction has been initiated but hasn’t been fully processed by your bank yet. It’s temporarily held and usually gets finalized within 24 to 48 hours.

A POS withdrawal is when money is withdrawn from your account during a debit card purchase at a point of sale. It’s commonly used when getting cash back during checkout.

A POS debit card transaction is when you use your debit card to pay for something at a merchant’s checkout — whether that’s in-store or online. The payment is taken directly from your bank account.

A POS hold on a debit card is a temporary authorization your bank places on your account for the estimated purchase amount. This happens before the final amount is settled.

A POS debit charge is a fee or deduction shown in your transaction history, indicating that your debit card was used to make a purchase at a point of sale.

POS debit recurring means a repeating transaction made with your debit card, such as monthly subscriptions to services like Netflix or Peacock. The charge occurs automatically.

A debit POS signature decline fee is a penalty some banks charge when a debit card transaction that requires a signature is declined — often due to insufficient funds or exceeding your card limits.

Yes, a POS debit can be reversed if the transaction was unauthorized, duplicated, or processed in error. Contact your bank immediately to file a dispute or chargeback request.

The POS limit in debit card is the maximum amount you can spend on Point of Sale purchases within a day. This limit is set by your bank for security and account management.

Upgrade Your Business with Smarter POS

At Hulm Solutions POS, we develop professional, high-performance point-of-sale systems tailored to meet the demands of modern businesses. Our solutions go beyond basic transactions, offering seamless performance, intuitive user experiences and the scalability needed to support long-term growth.