Point of sale purchases in these modern days go beyond the traditional cash register purchase. Today’s systems are all integrated and cloud-based along with being mobile so that businesses can sell in any place at any time. When one speaks of POS purchase, they are referring to the different systems through which the sale is completed, a hardware device like a card reader or some other devices associated to process the transaction, and all other attached tools that handle it all behind the curtain.

Let us deep-dive to understand POS Purchases: their definition, meaning, benefits, workings, and necessity in today’s retail and digital world.

Learn about: How does POS Machine work? Click Here!

What is a POS Purchase?

When you use your debit card at a store, tap your phone to pay, and use a credit card to complete a transaction, that moment is called a POS purchase. But what does it mean? Simply put, POS means “point of sale.” So, a purchase at the POS occurs when a sale transaction is completed – in most cases, at a checkout counter, in a self-service kiosk, or even online. It is the final moment when you spend your money, digitally or in any other means, and the goods or services are yours.

POS purchases are how we interact with the world in our daily lives: whether buying coffee, purchasing groceries, or even checking out online, we’re performing a POS transaction. These systems are vital for any business; fast processing of sales, accurate tracking and controlling of inventory, management of staff, and, including promotional and customer information, are all possible with them. That little beeping noise when you do your cards? That’s part of a massive system at work.

Learn about: What is POS Experience? & POS Reconciliation Click Here!

POS Purchase Meaning

A POS purchase is a transaction occurring at a Point-of-sale. The point where the buyer pays and the seller delivers the good or service. It could be at a store, restaurant, mobile vendor, or online shop.

Imagine you are at your favorite coffee shop, and you go ahead with a latte order. The barista rings it up. You now insert your card and have a successful transaction, concluding the sale. In real-time, that is a point-of-sale purchase. The moment-of-sale occurs at that moment in time: at the counter, on the tablet, or through a mobile app- where it all comes together.

Learn about: What is a POS Person? & What is POS skills? Click Here!

The POS purchase meaning is more than simply a card payment. The entire process, which includes choosing an item, having it scanned, calculating tax, taking discounts into account, processing it to complete payment, and finally producing a receipt, has also been encoded. All of these are entered in a system, the so-called point of sale, in a manner that is accurate, efficient, and seamless to the customer.

Today, the term also refers to the technology that powers these transactions. So when businesses talk about investing in a new POS system, they’re looking to improve how customers pay and how operations are managed. For customers, the goal is fast, hassle-free checkouts. For businesses, it’s all about speed, tracking, and convenience.

POS Purchase Definition

The technical definition of a POS purchase would be a transaction taking place at a location where retail sales are consummated and where goods or services have changed hands for payment accepted by the POS system.

This definition, then, applies to both a physical and digital environment. It’s about more than just going to a store and buying something. Modern POS systems now allow an aspect of the purchase to happen through a mobile app, website, self-checkout machine, or even a QR code at a table in a restaurant.

A modern POS purchase typically involves:

- A POS terminal or device (could be a tablet, touchscreen system, or mobile phone)

- Payment processing software

- A payment method (card, digital wallet, cash, or contactless payment)

- A backend system to track sales, inventory, and customer data

POS purchases run deep into business workflows. Thus, every time a sale occurs, data is being inputted into the system. Right from these little purchase moments, owners can gain insights into the best-selling items, busy hours, and revenue increase.

The definition of POS purchase would also include security features. With encryption, EMV chip cards, and compliance to PCI standards, businesses offer their customers a safe platform for their transactions. In this era, when data breaches can come pricey, a secure POS purchase system isn’t an option; it is a necessity.

How Does a POS Purchase Work?

Let’s walk through the full cycle of how a POS purchase works — from the customer’s first action to the final sale confirmation. The process is more detailed than it seems on the surface.

Key Components of a POS Transaction

- Product Selection – The customer picks out products or adds them to a cart (physical or digital).

- Item Scanning or Input – At checkout, items are scanned or manually entered into the POS system.

- Price Calculation – The system calculates the total cost, including taxes, discounts, or coupons.

- Payment Method Selection – The customer chooses how to pay: card, mobile wallet, cash, etc.

- Transaction Authorization – For card payments, the system contacts the bank to approve the transaction.

- Receipt Generation – A digital or paper receipt is created and optionally emailed or printed.

- Inventory Update – The system updates stock levels to reflect the purchase.

Example of a POS Purchase in Action

Let’s assume you wish to buy a shirt from a boutique clothing store that has one more piece of clothing. You present the shirt to the cashier for purchase. The employee scans its barcode and the price appears on the POS system. You tap your phone and pay with Apple Pay. The payment gets approved in seconds. The store emails you a receipt and updates its inventory. This is how smooth a POS purchase is – through and through – with tech doing all the work.

The process may vary slightly for online stores or mobile POS setups, but the structure remains the same: initiate purchase, calculate cost, process payment, and record data.

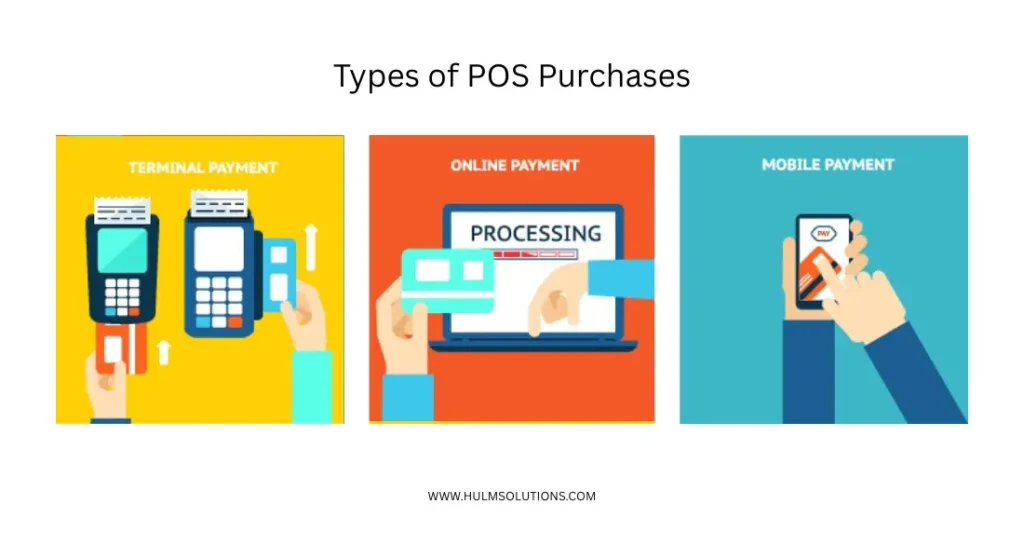

Types of POS Purchases

Not all POS purchases happen at a cash register. Today, several types of POS systems support various kinds of transactions. Let’s look at the most common ones.

In-store POS Purchases

The traditional POS purchase means the business is happening at a physical location, say a grocery store, restaurant, or salon. The setting usually consists of a touchscreen monitor, a barcode scanner, a cash drawer, and a card reader. This is still a hot favorite owing to its reliability and speed.

Mobile POS Purchases

Mobile POS systems are more embarrassing in the setting of the smartphone or tablet with a card reader attached. Food trucks, market vendors, or pop-up shops use this as an mPOS, which is a good choice for a remedy on the go-fits that bill outside very well. With added flexibility and portability, the true strengths of a traditional POS system come to the scene.

Online POS Systems

All e-commerce businesses use online POS systems integrated with shopping carts and payment gateways. These systems process credit card payments, compute taxes and shipping rates, and store digital sales records. Here, the POS “terminal” is the website itself, with all flows occurring entirely in a virtual world.

Benefits of POS Purchases for Businesses

Modern businesses thrive on efficiency, speed, and accurate data — and that’s exactly what POS purchases bring to the table. Whether you’re running a retail store, a café, or a mobile service business, leveraging a point-of-sale system can be a game-changer. Let’s dig into how POS purchases benefit businesses in real, measurable ways.

Faster Transactions

Time means money; this rule is especially obvious in an industry with high daily transactions. Traditional cash registers might have been sufficient, but today’s consumer expects speed and seamlessness in the checkout experience. This is where POS systems do their best work.

Whereas a typical POS purchase would have been pleasant and fast-close to mere seconds in the days of yore, with modern systems, it is a whole different ballgame altogether. Touch screens, barcode scanners, and tap-to-pay options run the show: Cashiers do not have to bother entering prices anymore or awkwardly asking customers to “Just hold on a sec.” Everything is virtually automated and instantaneous.

The fast-paced checkout becomes essential to serve more customers during busy times. Proceeds from this scenario increase directly, and customer satisfaction is also enhanced due to fewer human errors that minimize returns and disputes, thus saving you time.

Real-Time Inventory Management

Another major win? A sale being processed through the POS will update inventory levels in real time. As soon as any item is sold, it is deducted from the inventory. This real-time inventory update means that you will know exactly what you have on your shelves, what is fast-moving, and what is running low and needs to be ordered.

Now, you can set up alerts to tell you whenever an item in your stock becomes low or set up reordering automatically. This prevents the business from going into stockouts (which leads to lost sales) or overstocking (which ties up capital and storage risk).

Just imagine if you were the owner of a boutique and knew exactly which item sells best down to the item. Alternatively, you might be the owner of a restaurant whose POS system tells you when you’re close to running out of avocados. That’s the power of POS technology.

In addition, some POS systems provide various reports that show sales performance, customer tendencies, and profit margins. These reports enable data-driven decisions that will translate into actual business growth, all through the simple act of making a POS purchase.

Benefits of POS Purchases for Customers

Let’s not forget the other side of the POS equation — the customer. Consumers today expect convenience, speed, and flexibility. A POS system isn’t just good for the business on the other side of the counter — it provides an even better experience for the individual on its other end as well.

Convenience and Speed

Remember the days of digging for exact change or waiting for card slips to print? Thankfully, POS purchases today are much faster and more convenient. Whether a customer is tapping a contactless card, using Apple Pay, or scanning a QR code at their table, modern POS systems make checkout a breeze.

Speed is important — particularly in high-traffic settings such as coffee houses or busy apparel stores. A slow checkout line is a guaranteed way to anger customers and miss sales. POS systems reduce wait times by making every transaction faster and more efficient.

And, receipts can be sent via email immediately, reducing paper usage and providing the customer with digital confirmation of their purchase.

Multiple Payment Options

Flexibility is the name of the game in today’s economy. Shoppers today want to be able to pay how they prefer — whether that’s with a credit card, debit card, digital wallet, or even Buy Now, Pay Later (BNPL) methods. And guess what? A great POS system does it all.

Providing multiple payment options enhances customer satisfaction and your opportunity to make a sale. It also makes your business more accessible, reaching individuals who might not have cash or who prefer to use digital transactions.

For example, a POS sale at a miniature market stand can take anything from Venmo to contactless credit cards — all due to mobile POS technology. The more choices you offer, the better your customers will return.

Security and Compliance in POS Purchases

When it comes to handling payments, security isn’t just a nice-to-have — it’s an absolute must. One of the most critical aspects of a POS purchase is ensuring that every transaction is secure, compliant, and trustworthy for both businesses and customers.

Data Encryption and Tokenization

A modern POS system encrypts the sensitive customer information the second it’s entered. If someone swipes, inserts, or taps a card, the payment information is encrypted so it can’t be intercepted or tampered with. Tokenization — the process of replacing card information with a unique token during the transaction — is also used in many systems. This provides additional fraud protection.

With news of data breaches dominating headlines, this type of inherent security is not optional. Companies that do not secure payment information risk alienating customer trust — and quite possibly severe monetary penalties.

PCI Compliance

All businesses that handle card payments must follow the Payment Card Industry Data Security Standards (PCI DSS). A quality POS system helps merchants meet these requirements by offering tools and systems that comply with industry standards.

What does that mean for the customer? Peace of mind. Knowing their payment details are handled safely increases their trust and loyalty. For the business, it means reduced risk and a stronger reputation in the market.

Fraud Prevention Tools

Some POS systems also come with advanced fraud detection features. These might include:

- Real-time alerts for suspicious transactions

- IP address tracking for online purchases

- EMV (chip card) verification for in-person payments

- Two-factor authentication for staff using the system

Together, these tools make POS purchases safer, smarter, and more secure. So not only are you checking people out faster — you’re also doing it with top-tier protection behind the scenes.

Common Challenges with POS Purchases

While POS systems offer massive benefits, they’re not without a few hurdles. If you’re a business owner or someone considering investing in POS tech, it’s important to be aware of some common roadblocks you might face.

System Downtime

If the internet connection fails or the POS software freezes, it can halt your sales in their tracks. This is particularly agonizing during peak hours when a technical failure could translate into lost revenue. It’s worth selecting a POS system that provides an offline mode or cloud backup features.

Learning Curve for Staff

Not everyone on staff is necessarily tech-savvy, particularly in high-turnover businesses. Training will be needed to get everyone familiar with the system, and some POS systems have more of a learning curve than others.

Spend money on easy-to-use software and ongoing training and it can pay big dividends. Some POS systems even include interactive tutorials and support chat within the platform.

Integration with Other Tools

Most businesses employ other third-party applications for accounting, payroll, e-commerce, or CRM. If your POS system isn’t well integrated with them, you might find yourself entering the same information into several platforms’ managements — wasting time and escalating the risk of mistakes.

Opting for a POS provider with robust third-party integrations can eliminate this headache and ensure that your operations run smoothly.

How to Choose the Right POS System for Your Business

Not all POS systems are created equal, and choosing the right one can make or break your sales process. So what should you look for when shopping around?

Think About Your Type of Business

Restaurants, retail stores, salons, and service establishments all require varying levels of POS functionality. A fast food establishment may need to focus on speed and kitchen ticketing, whereas a salon may need appointment scheduling integrated into the system. Knowing your essential requirements will enable you to choose the most suitable.

Ease of Use

A POS system must be simple. If it’s too overwhelming, it’ll bog down your employees — and annoy your patrons. Opt for a system that has a nice interface, smooth navigation, and rapid training abilities.

Payment Processing Fees

All POS systems that accept card payments will have a fee, but the rates differ. Some pay a flat percentage, others a fee per transaction. Be sure to know the fee structure so it doesn’t cut into your profits.

Scalability

As your company expands, your POS system should expand with it. Ensure the platform you use accommodates multiple locations, user roles, and sophisticated reporting capabilities.

Customer Support

Lastly, never underestimate the value of responsive customer support. When something breaks (and eventually, it will), you’ll want fast, knowledgeable help — not a support ticket that sits unanswered for 3 days.

Future of POS Purchase

The future of POS purchases is all about innovation, automation, and personalization. With technology advancing rapidly, we’re seeing a shift from traditional systems to AI-driven, cloud-based platforms that do much more than just process payments.

AI and Predictive Analytics

Next-generation POS systems are beginning to integrate AI-driven insights. They can forecast customer behavior, recommend upsells, and even reorder stock automatically based on sales trends.

Think of a POS system that understands when to replenish coffee beans, anticipates a customer’s go-to latte, or provides an exclusive discount to a lapsed customer. That’s the direction in which things are moving.

Contactless and Voice Payments

Contactless payments already have mainstream adoption, but voice payments and biometric verification (such as facial recognition) are not far behind. These are intended to make transactions even quicker and more secure.

Omnichannel Integration

Customers don’t shop in a single location anymore. They shop online, purchase in-store, use curbside pick-up, and return items via an app. The future of POS transactions is all about complete omnichannel integration — where sales, inventory, and customer data are synchronized across platforms without a hitch.

Conclusion

A POS purchase is so much more than a mere swipe or tap at the register. It’s a robust system that touches all aspects of the customer experience and business operations. From lightning-speed transactions to secure handling of data and real-time inventory management, POS technology is transforming the way the world buys and sells.

Knowing what POS purchase meaning and POS purchase definition refer to is important for businesses looking to remain competitive and effective. Using the right systems and tools, you can simplify your operations, delight your customers, and grow your bottom line — all from the point of sale.

Frequently Asked Questions

A POS purchase on your bank statement means a transaction made using your debit or credit card at a physical or online store using a point-of-sale system.

Yes, modern POS systems are encrypted and compliant with PCI standards, making them secure for processing payments.

Absolutely. Most modern POS systems support Apple Pay, Google Pay, Samsung Pay, and other mobile payment options.

A POS purchase is a retail transaction where you buy goods or services, while an ATM withdrawal is simply taking cash from your bank account.

Yes, many eCommerce platforms have integrated POS systems to handle online transactions, inventory management, and customer data.

This article is based on real-world retail experiences and backed by industry research from trusted sources like Investopedia, Trust Payments, and The Business Research Company. We’ve combined hands-on insights with expert data to ensure the information you’re reading is accurate, up-to-date, and valuable for anyone navigating the POS landscape in 2025.